Tariff Tidal Waves: Riding the Global Crossroads into a New Economic Order

Tariffs, Trump & the Change in Trust

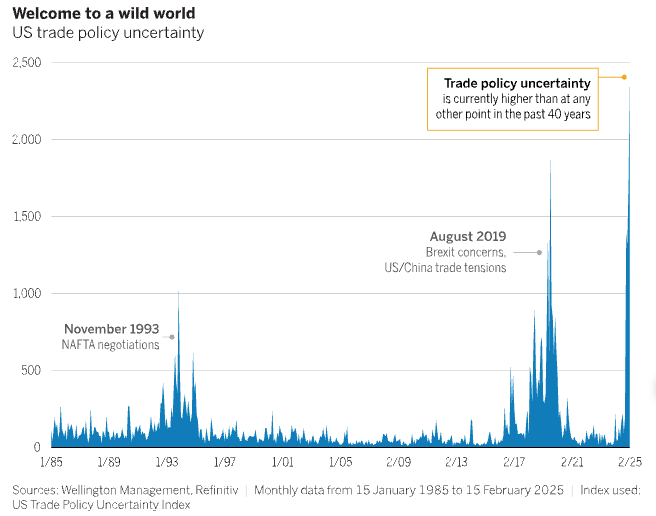

Anyone who knows me knows that earthquakes and tsunamis are high up in list of things I fear. Trump’s attack on globalization is nothing less than a fiscal earthquake with seismic aftershocks to be experienced for years, if not decades to come:

Yet beneath these dramatic policy moves lies a far broader and historically recurring transformation in the global order—a breakdown in the established monetary, political, and geopolitical frameworks. As we explore these dimensions, we also see how the rapid policy reorientation under the current U.S. administration is challenging long-standing norms and reshaping the credit and economic landscape both at home and abroad.

I. Market Shock and the Tariff Announcement

Even before the dramatic announcement of a universal 10% tariff accompanied by steep reciprocal duties—pushing effective tariff rates to levels reminiscent of the Smoot-Hawley era—a clear undercurrent of market stress was present. Over the past weeks, indices such as the S&P 500 and Nasdaq had already begun to decline as investor sentiment turned cautious.

II. Structural Forces: Beyond the Headlines

Though the tariffs themselves have dramatic immediate impacts, they are emblematic of deeper, systemic disruptions. While much attention is focused on these dramatic market shifts, most people are losing sight of the underlying circumstances that propelled such policies into action. Today’s environment is characterized by a classic breakdown in three major orders:

Monetary/Economic Order: Burdened by excessive debt and unsustainable capital market practices, the traditional interplay between debtor-borrowers (like the United States) and creditor nations (such as China) is under strain. The longstanding pattern—in which American manufacturing declines as it increasingly relies on foreign capital—may soon give way to significant recalibrations.

Domestic Political Order: In the U.S., rapid policy shifts and increased uncertainty are symptomatic of deeper domestic challenges. The erosion in confidence, rising income inequality, and political polarization are eroding the trust and stability traditionally associated with developed markets.

International Geopolitical Order: The era of U.S.-led multilateralism is giving way to more unilateral, “America First” stances. The disruption is not limited to trade; it extends to the realms of technology, military engagements, and a global rearrangement of power dynamics.

The rapid reorientation of U.S. policies—only two months into the new administration—has already dismantled many conventional norms and institutions. In most developed markets, such swift, wide-ranging change would trigger severe downgrades by rating agencies. However, the “exorbitant privilege” of the U.S. dollar and its institutional strengths have so far insulated the American economy from immediate recalibration.

III. Global Ripples and the Asian Equation

Tariff policies rarely remain confined within national borders. Asian economies, deeply integrated into global supply chains, are particularly sensitive to such policy shifts. For instance, China has retaliated with significant measures (a reported 34% tariff on certain U.S. goods), and other regional players in Japan, South Korea, and Southeast Asia are bracing for further impacts. This integration means that disruptions in U.S. trade policy have cascading effects throughout the region.

IV. Historical Precedents: Learning from Past Tariff Episodes

History offers vivid illustrations of the potential fallout from aggressive tariff policies. The Smoot-Hawley Tariff Act of 1930 is a prime example—protectionist measures led to retaliatory tariffs worldwide, deepening the Great Depression and significantly altering global trade dynamics. More recently, episodes during the Global Financial Crisis underscored how quickly market sentiment can shift when traditional orders break down.

These historical instances serve as cautionary tales. Aggressive tariffs may seem appealing as immediate remedies but can trigger systemic disruptions—provoking not only economic slowdown but also lasting changes in political and monetary orders.

V. Shifts in Institutional Architecture and Credit Dynamics

The current U.S. policy environment adds another layer of complexity. In merely two months, the new administration has upended many longstanding institutional norms. Unlike emerging markets—where such rapid changes would typically attract immediate rating downgrades—the U.S. still benefits from the dollar’s role as the global reserve currency and the leverage of its established institutions.

However, the wider impacts of these swift changes are already evident. Comparative analyses have started to question the creditworthiness gap between the U.S. and certain Gulf Cooperation Council (GCC) nations, including the UAE. For instance, recent reclassifications have seen Qatar and Kuwait transition to developed market status as their cost-of-living thresholds have consistently exceeded emerging market criteria. The UAE, too, is on a trajectory of robust growth and infrastructural transformation that may eventually force rating agencies to re-assess its standing vis-à-vis traditional AAA peers.

Key metrics—GDP per capita, debt-to-GDP ratios, interest-to-revenue ratios, and sovereign net financial assets as a percentage of GDP—highlight a dramatic contrast. While the U.S. battles soaring debt levels (now more than 120% of GDP) and an interest-to-revenue ratio that is staggering by global standards, the UAE’s fiscally prudent management, coupled with ambitious diversification and structural reforms, suggests that it may outperform many traditional high-grade sovereigns in the longer term.

A deeper dive into sovereign credit metrics—from GDP per capita and growth volatility to net financial assets—reveals that while American institutional strength has traditionally conferred a rating advantage, its unsustainable debt levels and a shifting domestic political order could eventually erode that edge. In contrast, the UAE’s rapid structural transformation, robust diversification away from oil dependency, and focused capital market reforms are yielding impressive long-term growth metrics, despite its governance challenges on dimensions like voice and accountability.

VI. Policy Implications and Navigating Uncertainty

As policymakers and investors sift through these layered dynamics, several core themes emerge:

Monetary Imbalances and Debt Sustainability: The U.S.’s exorbitant borrowing levels and soaring debt-to-GDP ratios could force a long-overdue correction in global capital flows—a process that might eventually shift the dynamics of global reserve currency status.

Domestic and International Reordering: American domestic policy volatility and political polarization, coupled with a shift toward unilateral, “America First” policies, are reshaping international alliances and global trade structures. Such changes risk accelerating deglobalization and are already prompting counterparts in Asia and the Gulf to re-evaluate their strategic positions.

Credit and Institutional Reassessment: The rapid institutional changes under the new administration contrast starkly with the controlled, long-term reforms unfolding in parts of the GCC. For investors, these divergences signal both risks and opportunities. While short-term market swings induced by tariffs might prompt knee-jerk reactions, a longer-term view suggests that well-diversified portfolios—integrating traditional high-grade assets with emerging opportunities in regions actively restructuring their economies—will be crucial.

VII. Conclusion: A Broader Perspective on Tariff Turbulence and Global Realignment

Today’s tariff announcements are more than isolated policy shifts; they are symptomatic of profound, systemic changes affecting every facet of global economic and political life. Key takeaways include:

Beyond the Numbers: While the tariffs themselves have immediate disruptive effects on markets, they reflect deeper structural shifts in monetary orders, domestic political stability, and international geopolitical alignments.

Global Repercussions: With Asian economies and forward-looking Gulf states like the UAE poised to benefit from structural reforms and diversified growth, the impact of these tariffs extends well beyond U.S. borders.

Historical Lessons: Past protectionist episodes remind us that aggressive tariffs can spiral into deeper crises, yet they also offer instructive parallels that help frame today’s challenges.

Institutional Dynamics and Credit Considerations: The rapid transformation of U.S. policy frameworks—coupled with unsustainable debt practices—contrasts with the disciplined, long-term reforms in emerging developed markets like those in the GCC, potentially redefining credit paradigms in the coming years.

Strategic Investment: Given the uncertainties, investors are well-advised to maintain diverse portfolios and avoid hasty liquidation decisions while carefully monitoring these converging trends.